Market Sentiment Indicators

This article will discuss the most popular indicators of market sentiment used by traders and investors in financial markets.

Let’s start with a definition. Sentiment indicators are graphical or numerical tools that show how a group of people feel about the state of the market, business environment, and other processes or phenomena. These indicators quantify the effect of various factors, such as unemployment, inflation, and macroeconomic conditions and policies, on the behavior or development of a process or phenomenon.

When discussing sentiment indicators in relation to financial markets, it’s important to note that they reflect the overall sentiment or, in other words, the consensus among market participants regarding the current price movement of a financial instrument.

What are the practical benefits of assessing market sentiment?

Clearly, if you learn to accurately assess investors’ and traders’ levels of optimism and pessimism in the market, you can profit from it.

For example, a bullish market means that most participants have opened or are preparing to open long positions because they believe the price will continue to rise. Conversely, when bearish sentiment prevails, the majority of market participants have opened or are preparing to open short positions because they believe the price will fall further.

However, as you know, it’s impossible for all market participants to be either buyers or sellers. Therefore, when extreme bullish or bearish sentiment emerges, traders should consider protecting their unrealized profits and possibly opening a position in anticipation of a trend change. Key market reversals tend to occur when 60% or more of financial analysts and advisors are bullish or bearish. In other words, once the vast majority of market participants recognize a trend and want to join it, that trend is coming to an end.

On the other hand, as is well known, most of the time—according to various estimates, between two-thirds and three-quarters—the market is in a state of consolidation or exhibiting a weak bullish or bearish trend. For this reason, situations in which market participants’ sentiment is neutral or mixed (i.e., neutral-bullish, neutral-bearish, or equally distributed) are more common. In such market situations, a trader’s strategy is to identify the strongest group of players (bulls or bears) and, when the market exits the consolidation phase, join them. Then, they trade according to their strategy in the direction of the dominant trend.

To understand how sentiment affects the financial instrument you are trading, you must determine the general mood of all market participants. The main principle of technical trading is to study market participants’ actions (i.e., price, volume, open interest, and volatility) rather than their words and thoughts. This requires studying market statistics as thoroughly as possible. Note that most sentiment indicators study more than just the price dynamics of a particular instrument or index to determine market participants’ mood and expectations.

Balance of Power Chart

How can market sentiment be measured? Currently, there are several different types of market sentiment indicators. Furthermore, each market—be it the stock market, commodity futures market, or Forex market—uses indicators specific to its own market.

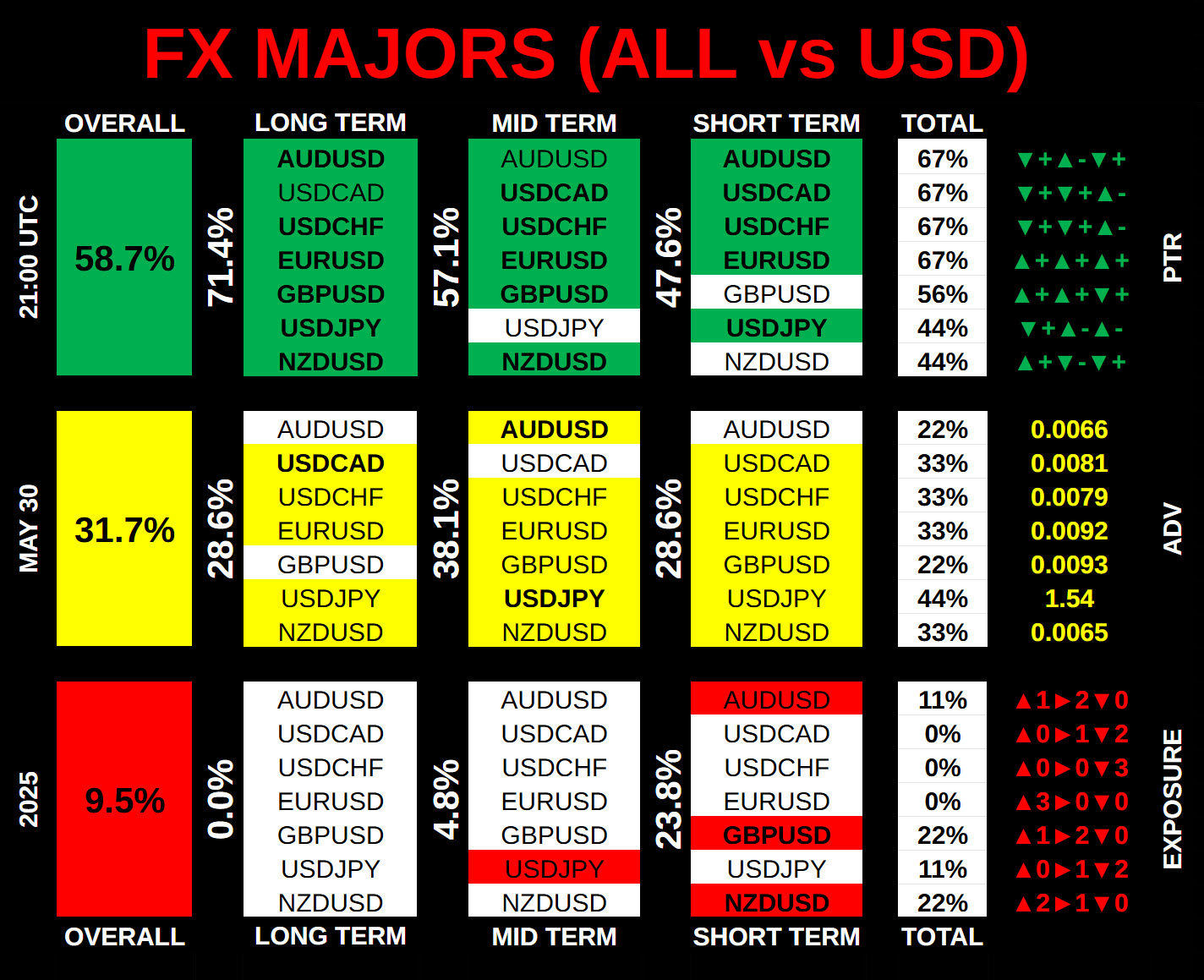

The diagram below shows the “Balance of Power Chart,” also known as the “Market Sentiment Chart.” It illustrates market sentiment within a selected financial market segment. Here, you can see the current situation in the major currency pairs segment of the Forex market. The “Balance of Power Chart” is a graphical diagram developed by the founder of GMT Partner project that shows the sentiment of three groups of market participants. The diagram is based on technical signals from three trading strategies developed by the project founder. Signals (the power of bulls, neutrals, and bears) are evaluated on a scale of one to three points. Then, the final balance of market participants’ forces is calculated and displayed in the diagram. Learn more about how the diagram is built here.

The “Balance of Power Chart” is divided into several sectors that reflect the technical picture of financial instruments from the perspective of a specific trading strategy. As you can see, there are LT, MT and ST sections, that correspond to the long-, medium-, and short-term technical pictures of the market, respectively. The W&L (winners and losers) sector shows the balance of power for each instrument, and the ALL sector corresponds to the general bullish, bearish, or neutral sentiment within the selected market segment.

Please note that the level of bullish, bearish, or neutral market sentiment for a given currency pair is determined in relation to the U.S. dollar. For example, when working with currency pairs such as AUDUSD, EURUSD, GBPUSD, and NZDUSD, where the U.S. dollar is the quote currency, remember that the prevalence of bullish sentiment over bearish sentiment according to the “Balance of Power Chart” indicates a higher probability of an increase in the value of the base currency (AUD, EUR, GBP, or NZD), and vice versa. For currency pairs such as USDCHF, USDCAD, and USDJPY, where the U.S. dollar is the base currency, bullish sentiment outweighing bearish sentiment indicates a higher probability of an increase in the value of the quote currency (CHF, CAD, or JPY). The “Technical Profile” of a financial instrument enables you to create a “Balance of Power Chart”, which is a representation of market participants’ sentiment within a financial market segment, such as the precious metals, energy, or cryptocurrency markets.

The diagram below represents the balance of power within the major currency pairs segment (FX Majors).

Similarly, this chart allows one to determine the balance of power among market participants within the following global market segments: cross rates of major currencies, precious metals, energy, cryptocurrencies, grains, meats, U.S. bonds, U.S. stock indices, and shares of individual companies in a given market sector.

How should the “Balance of Power Chart” be used?

After analyzing the power balance of market participants within the selected market segment and after determining the financial instrument which shows a noticeable advantage of bullish or bearish sentiment and provides a good opportunity for a trade, it remains to determine the technical parameters of the trade. In other words, it remains to determine the optimal levels for the position opening and closing, that could provide an acceptable level of risk and attractive P/L ratio.

For additional information, the “Balance of Power Chart” includes the average daily volatility parameter (ADV) of a financial instrument, the total number of formal positions opened for each financial instrument according to the three respective strategies’ rules (Exposure, Longs/Neutrals/Shorts), and statistics on the last trade signals generated by the three strategies (PTR: previous trade result and direction).

In conclusion, it should be noted that market sentiment indicators do not provide precise signals for opening a position. Reaching an extreme value does not mean that traders should immediately start looking for opportunities to buy or sell. These indicators should be considered supporting tools that indicate the preferred direction of the transaction. They can help decide whether to look for opportunities to go long or short, but they will never tell you when to open a position. Traditional tools of technical and fundamental analysis must be used to answer this question. It should also be noted that indicators of market sentiment are most effective on daily charts and larger timeframes.

The GMT Partner project offers its customers a subscription to the “Balance of Power Chart”, which covers a variety of segments of the global financial market. This service is intended for active traders and investors. To subscribe to the “Balance of Power Chart” for specific market segments, please send your request here or make your order here.

DISCLAIMER:

The risk of loss in trading Forex, futures, stocks and options can be substantial and is not suitable for all investors. Past performance is not necessarily indicative of future results. GMT Partner Ltd only provides educational services. By accessing any GMT Partner Ltd content, you agree to be bound by the terms of service. Testimonials are believed to be true based on the representations of the persons providing the testimonials, but facts stated in testimonials have not been independently audited or verified. Nor has there been any attempt to determine whether any testimonials are representative of the experiences of all persons using the methods described herein or to compare the experiences of the persons giving the testimonials after the testimonials were given. The average reader should not necessarily expect the same or similar results. Past performance is not necessarily indicative of future results. No person was compensated for providing a testimonial.