Dear reader!

Welcome to the second module of GMT Partner training course. The main topic of this module is the proprietary short-term trading strategy “Double Barrel Gun”, the additional topic of the module is “Evaluation of the effectiveness of trading strategies”.

“Double Barrel Gun” trading strategy was developed in 2002, it was initially used for trading only the instruments of the Forex market. Currently, in addition to currencies, this strategy is also used for short-term trading in futures and stock markets.

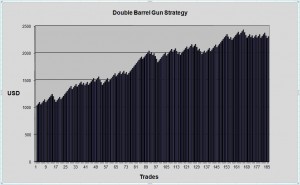

“Double Barrel Gun” trading strategy was first tested on historical data in 2003. The conservative method of capital management applied to the strategy produced more than 140% profit in less than one year, while the drawdown did not exceed 10%.

The distinctive features of “Double Barrel Gun” trading strategy are its simplicity, reliability, and versatility. The core of the strategy is a pair of moving averages and the volatility parameter of the financial instrument. The average duration of trade is 1-6 hours.

Curriculum of the second module

The second module of the course has to be completed within one month. In the second module you should:

- Familiarize yourself with the educational materials (PDF);

- Watch a series of video lessons (video);

- Schedule and receive a consultation from mentor, if necessary (contacts);

- Take the final test (12 questions);

- Perform the practical task to consolidate the material (conduct 10 trades in accordance with the rules of the strategy).

We recommend that you adhere to the following curriculum:

| Educational process | Week |

| Video-course | W1-W2 |

| Textbook and slide presentation | W1-W2 |

| Consultation | W2-W3 |

| Final test | W4 |

| Practice on demo account | W2-W4 |